ATA Predictions: Spot Market Carriers Facing Uphill Battle

At the 2023 American Trucking Associations (ATA) Management Conference & Exhibition in Austin, Texas, the trucking industry was presented with a sobering message from ATA Chief Economist Bob Costello. He painted a grim picture of the current state of the freight market, particularly for carriers heavily reliant on the spot market. Costello’s analysis emphasized that recovery from the ongoing freight recession hinges on a supply-side correction rather than an increase in freight demand. In this article, we delve deeper into Costello’s predictions, the factors contributing to the downturn, and the challenges and opportunities for the trucking industry.

Spot Market vs. Contract Loads:

One of the key indicators of the industry’s struggles is the significant disparity between the spot market and contract loads. Since early 2022, spot market load postings have plummeted by a staggering 78%, while contract loads have experienced a more modest decline of 3.3% compared to the previous year. This divergence underscores the challenges carriers face operating in the spot market, where uncertainty and volatility are more pronounced.

The shift in Consumer Spending:

One of the primary drivers of the freight downturn has been the shift in consumer spending patterns. During the initial stages of the COVID-19 pandemic, consumers focused on goods such as appliances, home improvement, and e-commerce purchases. However, as the situation improved and restrictions eased, there was a notable pivot towards experiences like vacation travel, concerts, amusement parks, and sporting events. This shift in consumer behavior, with experience spending outpacing goods spending by a substantial margin (33.6% to 17.5%), significantly impacted the demand for freight services.

Rising Driver Wages:

Costello pointed out another significant challenge faced by carriers: the rapid increase in driver wages. Over the last three years, average hourly earnings for truck drivers have surged by more than 20%, significantly outpacing earnings in the broader U.S. job market and the rate of inflation. While higher wages are undoubtedly a boon for truckers, they place immense pressure on carriers’ profitability, especially those operating in the spot market with already thin margins.

Fuel Costs:

While fuel costs have moderated compared to the previous year, they remain a notable concern for carriers. Crude oil prices approaching $90 per barrel potentially erode carrier profitability. Given the fragile state of the spot market, even slight increases in fuel costs can significantly impact carriers’ bottom lines.

Used Equipment Challenges:

Many new entrants in the trucking industry that started their businesses during the mid-pandemic freight boom found themselves grappling with historic premiums for used equipment. The price of used trucks skyrocketed by a remarkable 205% from the pandemic to the beginning of 2022. This forced small businesses to purchase older equipment at prices close to what they would have paid for newer vehicles. The strain of high equipment costs exacerbates the financial challenges small carriers face.

The Road to Recovery:

Despite the grim outlook, Costello offered a glimmer of hope. He indicated that a supply-side correction could pave the way for a more favorable future. As supply leaves the industry, and with demand expected to improve in the coming quarters gradually, there is a possibility of relief for carriers. However, the road to recovery will be fraught with challenges, and those heavily exposed to the spot market will need to navigate these turbulent waters carefully.

Bob Costello’s predictions at the 2023 ATA Management Conference & Exhibition are a stark reminder of the harsh realities facing the trucking industry, particularly carriers operating in the spot market. While challenges abound, the industry has shown remarkable resilience in adversity. Recovery will demand adaptability, strategic planning, and a keen eye for market dynamics. Only time will tell how spot market carriers weather the storm and emerge stronger on the other side.

STAFF CONTRIBUTIONS

Over the Road Truck Drivers: Get Ready for 2024 With This Comprehensive Checklist! We Will Be Covering Insurance, Health, Career, and More.

Continue ReadingDiscussing The XPO Road Flex Program: Potentially Exciting Opportunities for Truck Drivers in What XPO Calls a "Dynamic, Efficient, and Cost-Saving Program."

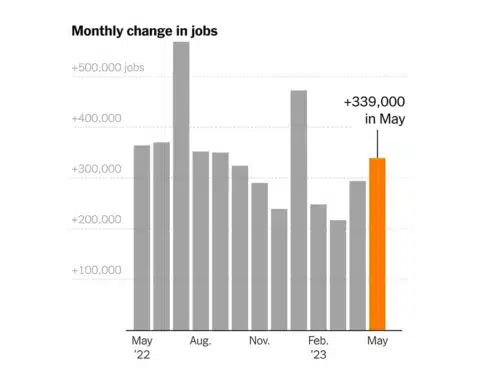

Continue ReadingIn a promising sign of economic recovery, May 2023 witnessed a significant increase in employment across various sectors, reinforcing hopes of a strong post-pandemic rebound. The latest

Continue ReadingADDITIONAL NEWS

The American Trucking Associations (ATA) has expressed strong opposition to the Department of Justice's proposed rule of marijuana reclassification.

Continue ReadingConnell High School in Connell, Washington, has formally petitioned the FMCSA to allow students under 18 to obtain commercial learner's

Continue ReadingIn an effort to increase efficiency and sustainability in Trucking, Phillips Industries has launched their new, advanced, stick-on solar panels

Continue ReadingThe U.S. government is increasing scrutiny on Chinese companies that are potentially dodging tariffs by manufacturing Chinese EVs (electric vehicles)

Continue ReadingIn a legal battle that could reshape the trucking industry, 24 Republican states join to bring a lawsuit against the

Continue ReadingOOIDA • ATA • DOT • NASTC • WOMEN IN TRUCKING • NPTC • DRIVER RESOURCES • TDN STAFF • ARCHIVES • SITEMAP