As we approach National Truck Driver Appreciation Week, it is imperative to delve into the pivotal role these drivers play and understand why honoring their efforts is

More

May 19, 2024 1:10 pm

In the world of trucking and freight transport there’s a mix of challenges and opportunities shaping the landscape. Recent data shows a view with Canada and the U.S. Both seeing fluctuations, in spot market activity, tonnage growth, market rates and trailer orders. While the industry still faces effects from a freight recession there are signs pointing towards economic growth.

For hire truck tonnage in the U.S. Rose by 2.1% in June after a 1.2% increase in May. While this uptick is encouraging it’s important to approach since the tonnage index suggests that the industry is still in recession territory. According to ATA economist Bob Costello, factors contributing to the freight recession include consumer spending on goods reduced home building activity, declining factory production and shippers consolidating their freight shipments.

Although there was an increase in tonnage recently year over year figures indicate a continued decline of 0.8%. However it seems that the rate of decline year, over year is showing signs of improvement which could suggest that the freight market is nearing stability.

The American Trucking Associations (ATA) recently published its report, on Trucking Trends providing insights into the trucking sectors impact on the U.S. Economy. In 2022 the industry transported over 11.4 billion tons of goods generating revenue exceeding US$940 billion. Despite facing challenges that year the trucking industry displayed growth in areas such as revenue, freight volume and employment. Moreover trucking remained a force in the transportation sector by handling 61.9% of the value of surface trade between the U.S. And Canada.

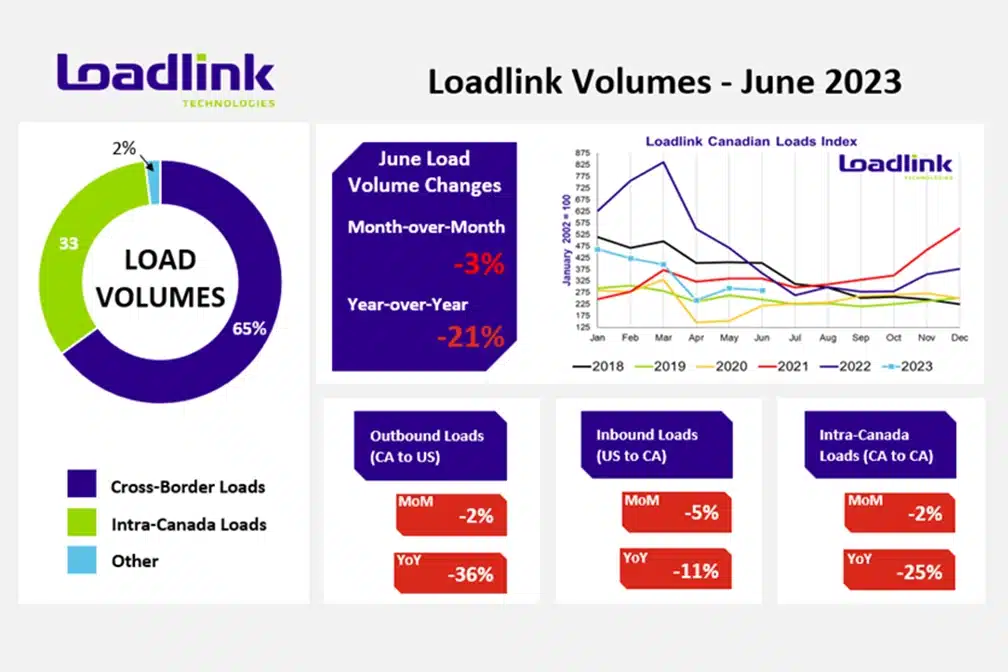

In Canada there was fluctuation in the spot market activity in June with postings for both trucks and loads. Similarly the U.S. Spot market witnessed a prolonged period of rate decline with rates dropping for seven weeks in July. Specifically dry van rates hit their point since August 2020 while flatbed rates also decreased to their levels since January 2021.

Despite these challenges there is a ray of hope for the industry as indicated by the DAT Freight & Analytics report which suggests that the disparity, between spot and contract rates is narrowing – hinting that spot truckload prices might have reached their point in the freight cycle.

The latest findings indicate an uptick, in prices for van and refrigerated freight providing some hope for the industry.

Recent data from ACT Research shows a 34% drop in trailer orders compared to the month with a year over year decline of 75%. However experts suggest that this decrease is more due to inventory management by dealers than a lack of demand from fleets. It is common for trailer manufacturers to reduce their order backlogs around mid year which likely explains the decrease in orders. Despite this slowdown the backlog of trailer orders remains robust indicating demand in the market.

The Canadian Federation of Independent Business (CFIB) has released an outlook projecting an improving growth trajectory for Canada. The report anticipates a rebound in growth to 1.4% in the third quarter alleviating concerns, about a looming recession. Additionally it forecasts that consumer price index (CPI) inflation will continue to decrease and align within the Bank of Canadas target range of 1 3%.Industry Experts Share their views.

Murray Mullen, the chairman of Mullen Group shared his thoughts on the state of the economy and the decline, in freight activity. He pointed out that many companies had miscalculated their supply chain needs in years resulting in an oversupply of goods. This led to a decrease in freight volumes in 2023 prompting increased competition and lower prices in the industry. This shift marked a departure from the freight market seen in 2022 to the downturn.

In summary the economic landscape of the trucking sector presents a mix of obstacles and signs of progress. While challenges persist due to the freight slump indicators such as tonnage growth and narrowing gaps between spot and contract rates suggest a potential recovery ahead. With industry players adjusting to changing market conditions there are promising opportunities for growth and resurgence, on the horizon.

As we approach National Truck Driver Appreciation Week, it is imperative to delve into the pivotal role these drivers play and understand why honoring their efforts is

MoreThe trucking industry, often considered the lifeblood of the American economy, has had its fair share of challenges in recent years. From the disruptive impact of the

MoreAs a truck driver, you possess a wealth of knowledge and firsthand experiences that are valuable not only within your industry but also to the general public.

MoreThe American Trucking Associations (ATA) has expressed strong opposition to the Department of Justice's proposed rule of marijuana reclassification.

MoreIn an effort to increase efficiency and sustainability in Trucking, Phillips Industries has launched their new, advanced, stick-on solar panels

MoreThe 2024 CVSA International Roadcheck is scheduled for May 14-16. Over 72 hours, inspectors across the US will conduct nearly

MoreAutomated License Plate Readers are a major advance in law enforcement technology but they raise significant privacy and oversight challenges.

MoreThe EPA's latest emission standards detailed in a final rule issued on March 29 are sparking vigorous debate within the

More