Latest Spot Market Results: Dry Van Gains in Holiday Week

Dry van rates surged during Thanksgiving week as the Spot Market saw higher rates, lower load volumes, and mixed trends in reefer and flatbed segments.

Spot Market Sees Sharp Dry Van Rate Jump During Thanksgiving Week

The Spot Market showed a strong shift during Thanksgiving week as dry van rates climbed at their fastest pace in months. Although refrigerated rates slipped and flatbed rates barely moved, the rise in dry van rates pushed the overall market rate to its highest weekly gain in eight weeks. These moves followed normal holiday patterns, which often bring strong dry van increases, softer refrigerated rates, and steady flatbed pricing.

Spot Market Load Volumes Drop During the Holiday Week

Total load activity fell 46.2% during the week ending November 28. This steep drop is typical for Thanksgiving week. However, a calendar change compared to last year made the year-over-year numbers look unusual. Thanksgiving landed in week 48 in 2024’s Truckstop data instead of week 47, which means this year’s holiday week showed load volumes about 37% lower than 2024’s week 47. Yet when compared with last year’s true Thanksgiving week, total volume was almost 15% higher.

Truck postings also fell 17.2% during the holiday period. As a result, the Market Demand Index dropped to its lowest point since late last December. Even with that decline, the market still showed signs of strength once the holiday timing was taken into account.

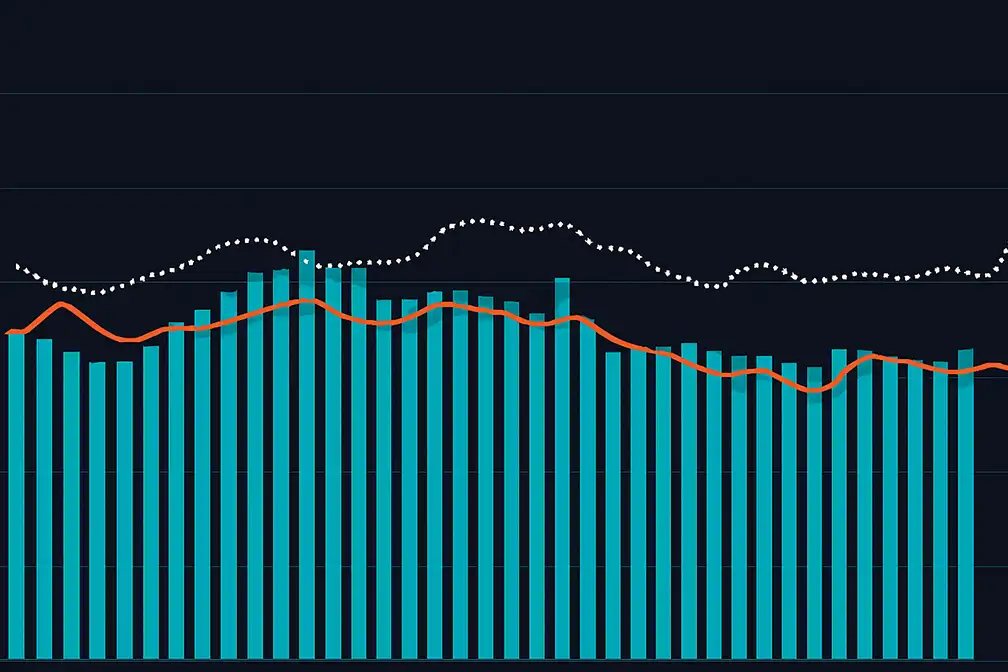

Overall Spot Market Rates Rise for the Second Straight Week

Broker-posted rates climbed 2.5 cents after rising nearly 2 cents the week before. Rates were more than 2% higher than during 2024’s week 47 and nearly 3% higher than last year’s Thanksgiving week. In recent years, dry van rates often continued rising in the week after Thanksgiving, while refrigerated and flatbed rates showed less predictable trends. This year’s pattern appears to follow that same direction.

Dry Van Spot Market Rates Post the Strongest Growth

Dry van spot rates jumped more than 13 cents week over week. This was the largest increase since the week ending July 4. Rates were nearly 8% higher than in 2024’s week 47 and almost 5% higher than during last year’s Thanksgiving week. Dry van loads, however, dropped 39.5%. Volume was still more than 30% below last year’s week 47 but more than 12% higher than last year’s holiday week. This contrast shows how demand tightened even as fewer trucks were on the road.

Refrigerated Rates Slip After Prior Gains

Refrigerated spot rates declined nearly 4 cents after rising almost 6 cents the prior week. Even with the drop, rates were more than 6% higher than during last year’s Thanksgiving week, though they remained 2.5% below 2024’s week 47. Refrigerated load volume also took a hit, falling 37.3%. That volume was about 49% below 2024’s week 47 level but only 12% lower than last year’s Thanksgiving week. This suggests that holiday swings continued to shape this segment more than broad market weakness.

Flatbed Rates Hold Steady

Flatbed spot rates were essentially unchanged, rising only a tenth of a cent after a small increase the week before. Rates were more than 3% higher than 2024’s week 47 and slightly below the increase seen in last year’s Thanksgiving week. Flatbed loads saw the largest declines among all segments, dropping 53%. Volume was about 36% below 2024’s week 47 but more than 32% higher than last year’s Thanksgiving week. Even though activity fell, the year-over-year gain during the holiday week points to improving demand conditions.

Outlook for the Spot Market Heading Into December

As the industry moves into early December, recent trends suggest that dry van rates could continue to rise, as they often do after Thanksgiving. Meanwhile, refrigerated and flatbed rates remain less predictable. Market watchers will pay close attention to how quickly load volumes rebound as drivers return from the holiday break.

Overall, the Spot Market remains active, shaped by seasonal factors, shifting demand, and the usual tight capacity during major holidays.