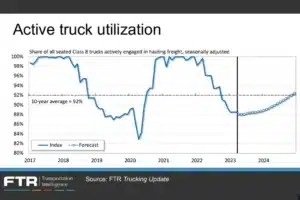

Economic Trucking Trends Loss of Capacity to Drive Recovery

Economic Trucking Trends- Loss of Capacity to Drive Recovery

Latest from Blog

Horrific I-95 Collision: Five People Die In A Truck Crash

AP News reports that a truck driver is facing manslaughter charges after five people died in a crash that shut down northbound Interstate 95 in North Carolina for nine hours Wednesday, according

Ryder’s Q2 Success: Surging Profit And New Revenue Records

Ryder System Inc. shared their earnings report for the second quarter of 2024, showing a big increase in profit and a steady rise in revenue. The company’s strategies and recent acquisitions have

Reversal of the Chevron Ruling: Senators New Bill

A group of Democratic senators, led by Senator Elizabeth Warren, is working to reverse a recent Supreme Court ruling. This ruling limits the power of federal agencies when they make regulations. It

Truck Hits an Overpass in B.C., New Penalties Enforced

British Columbia is taking strong steps to make roads safer and protect bridges from truck accidents. The recent suspension of SGD Transport Ltd. shows how serious the province is about these measures.

Indiana Safe Zones: New Initiative for Construction Areas

The Indiana Safe Zones program is a new effort by the Indiana Department of Transportation (INDOT). Started in 2023 through HEA 1015, this program aims to make construction sites safer for both